“Can you take me Higher? To a place where blind men see Can you take me Higher? To a place with golden streets” — Creed, Higher

In their seminal 1994 book Built to Last: Successful Habits of Visionary Companies, Jim Collins and Jerry Poras coined the term BHAG (pronounced BEE-hag) — an acronym that stands for “Big Hairy Audacious Goal.” Collins and Porras suggest that the very best companies set an audacious, very long-term goal that shines a light towards “an envisioned future.” BHAGs serve as a rallying cry for the company culture, an ambitious target for the future, and a focusing tool for corporate decision-making. As we turn the page to 2015, Uber has a new BHAG, and it’s name is UberPool.

A Quick Look Back

Before we dive deep on UberPool and explain why this program is worthy of being the company’s BHAG, let us first look back at some of the key strategic decisions in the company’s history. If you understand the journey that the company has taken up until now, the more clear it will be why UberPool is the obvious next step.

Uber’s founding tagline was “everyone’s private driver.” Today, the company’s mission statement is “transportation as reliable as running water, everywhere for everyone.” The common component of both the original tagline and the new mission statement is the word “everyone.” In order for Uber to serve everyone it is critical that Uber not only achieve price leadership, but that the company continually search for new ways to deliver transportation at lower and lower price points. This goal – to deliver the highest possible value to the customer – is a key catalyst for UberPool.

Delivering More Value to Consumers Through Lower Prices

Of course, Uber is not the first company to choose a corporate strategy of price leadership. Sam Walton and Jeff Bezos both espoused the benefits of rewarding customers with the highest possible value by delivering to them the lowest possible prices. What is really interesting is that both make the exact same non-obvious argument – that low prices are the very best way to maximize cash flow, and therefore equity value.

“… But this is really the essence of discounting: by cutting your price, you can boost your sales to a point where you earn far more at the cheaper retail price than you would have by selling the item at the higher price. In retailer language, you can lower your markup but earn more because of the increased volume.”

– Sam Walton, founder of Wal-Mart

“We’ve done price elasticity studies, and the answer is always that we should raise prices. We don’t do that, because we believe — and we have to take this as an article of faith — that by keeping our prices very, very low, we earn trust with customers over time, and that that actually does maximize free cash flow over the long term.”

– Jeff Bezos, CEO of Amazon

In a separate comment, Bezos was more direct in his commitment to delivering the lowest possible price point to Amazon’s customers, noting “There are two kinds of companies, those that work to try to charge more and those that work to charge less. We will be the second.” Like Wal-Mart and Amazon, this is Uber’s philosophy as well.

Learning From UberX Price Cuts

UberPool is actually Uber’s second major initiative targeted at lowering consumer prices. When Uber launched its low-cost UberX offering in the summer of 2012, the company quickly realized that the demand for its transportation services is HIGHLY elastic. As the company achieved lower and lower per-ride price points, the demand for rides increased dramatically. A lower price point delivered a much better value proposition to the consumer, yet still remained a great business decision due to the remarkable increase in demand.

Armed with this new data, Uber leaned on its legendary “math department” to help drive prices even lower. This is the name that founder and CEO Travis Kalanick has given to his team of scientists and hardcore mathematicians who own the back-end routing algorithms for Uber. Uber’s technology goes well beyond its client side smartphone applications; there is also a server-side intelligence system that provides demand prediction, congestion prediction, supply matching, supply positioning, smart dispatch, and dynamic pricing. These are the systems that help balance the more than one million rides per day that are matched on the Uber system.

The “math department” and management realized that if they could increase driver utilization (the number of rides per hour for a driver), then they could lower the price for the end user while maintaining earnings quality for the driver. Higher efficiencies through higher volumes and better algorithms could help deliver the desired lower price points and better cash flows. Interestingly, these lower price points would lead to more demand, even more liquidity, an even higher utilization, and then another incremental price decrease. Pretty quickly UberX passed UberBlack to become the highest volume service on the Uber platform.

Getting Ahead of the Game

Uber repeated this circular pattern so many times in so many different cities that some cities witnessed more than six price cuts in a brief two-year period. While these highly successful initiatives have lead to prices that can be as much as 40-50% below that of a taxi, this sheer number of price changes can be confusing to the ecosystem. This January, the company took an even bolder move announcing simultaneous cuts in 48 cities, and backing these up with income guarantees for drivers. How could they make such an aggressive move? Basically, the company’s immense historical database of supply and demand curves at different price points makes it easy to predict how these markets will evolve. This allows the company to “forward invest” capital to help these markets achieve lower consumer prices even faster. You might call this “betting on the math department.”

What is UberPool?

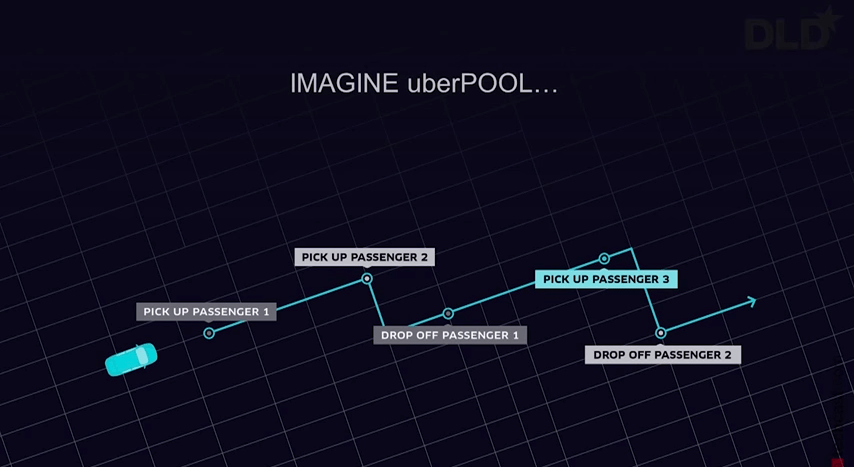

Which brings us to UberPool. The concept behind UberPool is rather straightforward (see graph below). Basically a single driver picks up not one, but two passengers who are headed in the same direction. She then drops off one passenger, and perhaps picks up a third before the first is dropped off. In this scenario, customers are literally “ride-sharing.” If you can manage the system such that each driver averages more than a single rider per trip, you can achieve an even HIGHER level of efficiency, and deliver even lower prices to the consumer. As you can see, this is the natural evolution after UberX and UberX price optimization.

This program is already up and running in San Francisco, New York, and Paris, and the company is already seeing habitual behavior with many riders using UberPool on the same route, five days a week.

The idea of UberPool may seem simple, but the implementation is unquestionably not. If you previously studied combinatorial optimization in theoretical computer science or operations research you may be familiar with the “traveling salesman problem,” or TSP. TSP problems require computationally intensive integer linear programming techniques to find exact solutions. Since there are too many permutations for these problems to be accurately solved, sophisticated heuristic approximation methods have to be developed. It turns out that writing the algorithms for UberPool is quite a bit more complex than a simple TSP, because (1) you have many more than one “salesman,” (2) the destinations are dynamic, (3) new “salesmen” are constantly entering and leaving the system, (4) vehicles have limited seating capacity, and (5) new requests for rides are continually streaming in. This is not just closer to the dynamic mTSP (multiple TSP) problem, which falls under the intimidating classification of “NP-hard,” but moreso under the broader and even more formidable VRP (Vehicle Routing Problem). The math department has plenty to do.

So what makes UberPool worthy of being the defining initiative at Uber?

- Magnifying the Positive Impact on Cities. UberPool will allow Uber to achieve radically lower price points, magnifying the already positive impact Uber is having in its partner cities. Uber is reducing drinking and driving, reducing the need for parking, and reducing congestion on our roads. With UberPool the company has the ability to further reduce traffic and congestion, potentially lowering pollution, and providing a real economic alternative to car ownership for the largest number of possible customers. Most cars sit idle 95% of the time. Does that really make economic or environmental sense?

- UberPool is Technically Difficult. Nailing UberPool is simultaneously “hairy” and “audacious.” UberPool is a technically challenging pursuit that will require the highest level of execution and innovation from the engineering team at Uber. Fittingly, these are the exact types of pursuits on which Silicon Valley companies thrive. Watch the video at the end of this post from the DLD15 conference in Europe (starting at 3:30 into the video), and you will see Travis Kalanick layout a vision for “the Perpetual Ride” whereby a driver would always have a customer in the car – an even more audacious vision.

- UberPool leverages Uber’s leadership position. This is really key. To make a concept like UberPool work you need a really high amount of base liquidity in the system – tons of cars and tons of riders. Otherwise, you will not have enough people moving in the same direction at the same time. Obviously, with its leadership position in the market, Uber is in the pole position to turn this concept into a reality. UberPool builds on the incredible scale that the company has already achieved, and can leverage the existing base of millions of customers that have already downloaded the application. With its recent multi-billion dollar fundraising, the company has stated that a large proportion of the funds are earmarked specifically to make UberPool successful. As with UberX price cuts, the company can use its substantial capital resources to forward invest in UberPool, increasing the likelihood of success. Betting on the math department again!

- UberPool is a platform for the future. Many people like to speculate as to whether or not Uber will eventually move beyond transporting people and into broader logistics. The technology and algorithms behind UberPool will lay the groundwork for the capability to do multiple stops with multiple cargos, increasing the future optionality for the Uber platform. So UberPool is a fundamental enabling technology for Uber in addition to providing lower price points and increased efficiency.

It is hard to imagine a world where Uber riders do not want faster pick up times and lower price points. Uber is 100% committed to leveraging its scale and volume to deliver ever lower prices for consumers. The company spent most of 2014 raising optimization and utilization, such that UberX could be as affordable as possible for the largest constituency possible. UberPool is the natural evolution of this journey, and obvious BHAG candidate for 2015 and beyond. In closing I would point you towards another Jeff Bezos quote that does a spectacular job of highlighting the motivations behind Uber’s obsessive push forward on UberPool.

“I very frequently get the question: ‘What’s going to change in the next 10 years?’ And that is a very interesting question; it’s a very common one. I almost never get the question: ‘What’s not going to change in the next 10 years?’ And I submit to you that that second question is actually the more important of the two — because you can build a business strategy around the things that are stable in time. … [I]n our retail business, we know that customers want low prices, and I know that’s going to be true 10 years from now. They want fast delivery; they want vast selection. It’s impossible to imagine a future 10 years from now where a customer comes up and says, ‘Jeff I love Amazon; I just wish the prices were a little higher,’ [or] ‘I love Amazon; I just wish you’d deliver a little more slowly.’ Impossible. And so the effort we put into those things, spinning those things up, we know the energy we put into it today will still be paying off dividends for our customers 10 years from now. When you have something that you know is true, even over the long term, you can afford to put a lot of energy into it.” ― Jeff Bezos

You must be logged in to post a comment.